Crypto may have made some quick millionaires—but in 2025, smart men are turning their focus to something they can actually hold. From vintage watches to aged whiskey and rare trading cards, alternative investments are becoming the new symbols of wealth, taste, and long-term strategy. Men are shifting from the volatile digital hype to physical legacy—investing in pieces that reflect both financial potential and personal identity. These assets offer a hands-on connection to value, blending profit with passion. Here’s what every man should consider in this evolving market.

1. Why Men Are Moving Away from Crypto and Stocks

The emotional toll of crypto crashes—like Bitcoin’s 30% dip in early 2025—and stock market unpredictability has left men weary. Volatility fatigue, coupled with a lack of control over digital wallets and the burnout from constant market monitoring, is driving a pivot to tangible wealth. A 2025 Fidelity survey revealed 40% of men under 35 cite “wanting something real” as their motivation, valuing items they can touch, display, or pass to the next generation. X posts reflect this sentiment, with users trading tales of lost crypto for stories of physical gains.

Takeaway: Assess your investment stress—start exploring tangible options to regain a sense of ownership.

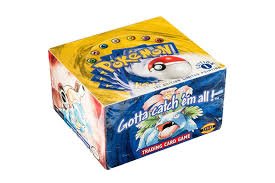

2. Trading Cards: The New Gold Standard for Collectors

The trading card market is booming, with Pokémon cards (e.g., a 1996 Charizard PSA 10 sold for $300,000 in June 2025), sports cards (Mickey Mantle rookies at $500,000+), and Marvel cards gaining traction. Scarcity drives value—only 1% of cards earn a PSA 10 grade—while platforms like Alt and eBay Vault provide secure storage and authentication. A 2025 MarketWatch report projects a 25% annual growth, with Gen Z leading the charge.

Takeaway: Invest in a graded Pokémon Base Set booster box ($50-$500) and follow PSA grading trends to build a collection.

3. Rare Watches: Legacy Timepieces with Investment Value

Luxury watches from Rolex (Submariner models up 40% since 2020), Omega (Speedmaster at $15,000+), and Grand Seiko (Spring Drive at $6,000+) are blending status with appreciation, offering daily wear and heirloom potential. A 2025 Chrono24 study notes a 15% rise in male buyers under 40, with pre-owned markets like Jomashop seeing high demand. These timepieces are both functional art and financial assets.

Takeaway: Purchase a pre-owned Omega Seamaster ($3,000-$5,000) from a reputable dealer and track its value over a year.

4. Whiskey: Liquid Gold That Gets Better with Age

Whiskey is a rising star, with limited-edition bottles like Yamazaki 18 ($2,000+), single-barrel Scotch (Macallan 25-year-old at $50,000 in a June 2025 auction), and Japanese blends entering portfolios. Aging enhances flavor and value, with platforms like CaskX offering fractional ownership starting at $500. A 2025 Whisky Advocate report highlights a 20% value spike, driven by collectors and connoisseurs.

Takeaway: Acquire a bottle of Hibiki Harmony ($150) to enjoy now and hold a rare Suntory ($1,000+) for future gain.

5. Art and Photography: Modern Taste with Long-Term Potential

The art market spans traditional fine art (e.g., Basquiat prints at $20,000+) and digital/physical hybrids (NFT-backed works like Beeple’s at $6,000+). Platforms like Saatchi Art offer emerging artists for $200-$1,000, while Masterworks enables fractional investing in blue-chip pieces with projected 12% annual returns, per a 2025 Art Basel study. It’s a blend of cultural capital and investment.

Takeaway: Start with a $200 Saatchi print or a $500 Masterworks share in a Picasso work to diversify your assets.

6. Sneaker Culture & Collectible Fashion

Fashion is turning into a vault, with Nike Dunks (some pairs at $10,000+), Yeezy Boost 350s ($5,000+), and luxury drops from Louis Vuitton (monogram trunks at $15,000+) leading resale markets. Scarcity and identity fuel this trend, with a 2025 StockX report showing a 30% rise in male collectors under 35. Drops are tracked on apps like GOAT.

Takeaway: Buy a limited-edition Nike Air Max ($150-$300) from a verified drop and hold for resale value.

Real Assets for Real Men

Alternative investments aren’t just about profits—they’re about passion, taste, and building a portfolio that says something about who you are. As 2025 unfolds, owning tangible assets is more than smart—it’s personal. It’s time to invest with intent and craft a legacy you can hold.

👉 Ready to build your alternative portfolio with purpose? Subscribe to MindGearMen for smart guides, collector spotlights, and tips on investing like a man who thinks long-term and lives with intent. You can also read our previous post on “Masculine Architecture: 6 Bold Design Trends Bringing Back Brutalism and Cabin Aesthetic in 2025“